Have you considered taking a Myers-Briggs Personality Type Indicator?

Article inspiration from Forbes, June 2020

Moderate stress is normal and has positive benefits. As stress levels ratchet up, however, our thinking can become clouded by negative emotion, and in these states, we can be prone to make poor decisions, as demonstrated by a 2017 study by Wemm and Wulfert.

Fast-forward a few years later and we find ourselves mired in one of the most stressful global situations we’ve seen in a long time. On top of worrying about our health and that of our loved ones and friends, we’re bombarded with news about illness and frightening economic statistics every day.

And many feel this stress acutely in the area of money management and investment. Numerous studies show stress can affect our approach to risk, which is strongly tied to investment strategy. The last thing you want to do right now is make poor investment decisions. But how do you stop stress from taking over and find a path to clear-headed decision-making?

Keeping Your Cool In Trying Times Starts With Self-Awareness

Self-awareness is key. If you know how your personality type affects your natural approach to risk-taking, as well as what stresses you out in the first place, you’re better able to keep yourself in check so you don’t make regrettable decisions.

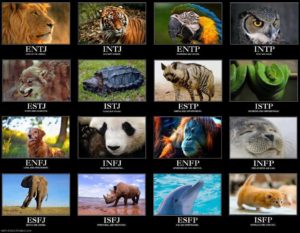

Let’s have a look at how personality preferences may influence our tolerance for risk, based on the Myers–Briggs Type Indicator (MBTI) type (I’m Director of U.S. Professional Services for The Myers-Briggs Company). For information on how to access your personality type, go HERE. MBTI type identifies whether we:

Let’s have a look at how personality preferences may influence our tolerance for risk, based on the Myers–Briggs Type Indicator (MBTI) type (I’m Director of U.S. Professional Services for The Myers-Briggs Company). For information on how to access your personality type, go HERE. MBTI type identifies whether we:

• Focus attention on the outside world of people and things (Extraversion) or the inner world of thoughts and feelings (Introversion)

• Trust and use information based on experience and the evidence of the five senses (Sensing) or consider the future and how things connect to make the big picture (Intuition)

• Make decisions on the basis of objective logic (Thinking) or of values and on how the decision will affect people (Feeling)

• Live in a more structured, organized way (Judging) or in a more flexible, spontaneous way (Perceiving)

How Personality Type Affects Risk Tolerance/Aversion

A study by Filbeck, Hatfield and Horvath found that investors with a higher tolerance for risk were more likely to have a Thinking preference, while those with a Feeling preference were more risk-averse.

Furthermore, a study by Desmoulins-Lebeault, Gajewski and Meunier also found that those with preferences for Introversion, Sensing, Feeling and Judging were more risk-averse. The team found an interaction effect between E-I and T-F — among extraverts — those with a Feeling preference were more risk-averse than those with a Thinking preference.

As stress reaches higher levels, we often tend to overuse our natural personality preferences. In other words, if we’re prone to be risk-takers, we may find ourselves taking bigger risks, and vice versa if we are naturally risk-averse. (In situations of prolonged extreme stress, like the death of a family member, this can change, but we’ll save this for another conversation.) By recognizing this tendency, we can check ourselves from some of the more extreme investment choices we might otherwise make.

Don’t Ignore Stress: Make The Necessary Changes

Seclusion, loneliness and isolation can be major stressors across several personality types. If this describes you, don’t dismiss it — do whatever you need to in order to get some social interaction in. Call friends, engage in group chats, etc. But don’t think that you should be able to “tough it out.”

Additionally, you probably noticed two camps — one that is stressed out by a loss of structure to one’s routine, and one that is stressed out by too much structure.

It’s easy to see how either of these could be someone’s reality right now. If you’re suddenly working from home, you may find that your routine has been unpleasantly disrupted and the structure you’ve built in your life is disappearing. If this is you, do whatever you can to bring structure and discipline back into your day.

On the other hand, some who prefer less structured work environments and are suddenly switched to remote work may find that their companies are asking more reporting and checking in, all in the name of accountability.

Either way, the path to clear-headed thinking, which is paramount to striking the balance between risk tolerance and risk aversion that’s necessary for sound money management, starts with asking yourself:

• What stresses me out?

• How is this increased stress level affecting my natural tendencies toward risk aversion or risk tolerance — will I tend to make more or less aggressive decisions?

• What elements in my life — particularly those relating to the current COVID-related changes — that are causing me stress do I have control over, and what can I do to mitigate them?